When I started blogging in 2007 my writing focused on the Federal Reserve's failure to properly handle the productivity boom of 2001-2004 and how this failure contributed to the global housing boom. This productivity boom--spawned by the opening up of Asia and the ongoing technological gains--increased economic capacity, put downward pressure on inflation, and implied a higher natural interest rate. The Fed, however, responded to the fist two developments as if they were signalling falling aggregate demand rather than rapid increases in aggregate supply. The Fed did this by failing to raise the federal funds rate when the natural interest rate rose and then kept it

well below the natural rate level for several years. Given the Fed's

monetary superpower status, this sustained easing created a global liquidity boom

that was a

key force behind the "global saving glut". This view was what initially drove most of my blogging.

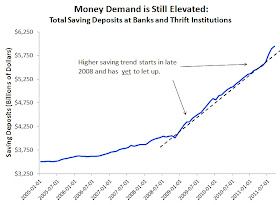

By late 2008 my focus began to change. I had been critical of the Fed for allowing too rapid growth in nominal spending during the first half of the decade, but by this time it seemed the Fed was erring in the opposite direction. Nominal spending was

falling fast and the Fed's seemed more focused on saving the financial system than in directly preventing the collapse of aggregate demand. The Fed's introduction of interest payments on excess reserves in October, 2008 only

served to confirm my fear that the Fed was too narrowly focused on financial stability. This fear combined with what I was reading from

Nick Rowe and Bill Woolsey (in the comments section initially) about the excess money demand problem and early

posts from Scott Sumner about the Fed causing the financial crisis by failing to stabilize nominal spending in the first place convinced me that the Fed had committed a colossal policy mistake in 2008. This failure to respond to the drop in nominal spending I later came to recognize as a

passive tightening of monetary policy (something that is easy to show using an

expanded equation of exchange).

As time went on, it also became apparent to me that the Fed was not forward looking enough. For example, as early as mid-2008 breakeven inflation from TIPs was indicating an aggregate demand slowdown was ahead. The Fed, however, at the time put more weight on backward-looking headline inflation measures as was evident in its decision to

not cut the target federal funds rate in the September, 2008 FOMC meeting. Modern macroeconomics and

experience tells that one of the most effective ways the Fed can influence aggregate demand is by managing expectations. Shape nominal expectations properly and one can immediately affect aggregate demand. As Scott Sumner likes to

say, the implication of this insight is that monetary policy works with leads not lags.

Now here we are in 2011 and the Fed has yet to, one, correct its

passive tightening of the past three years and, two, properly shape aggregate demand expectations by adopting something like a nominal GDP level target. It has been incredibly frustrating to watch the incredible amount of human suffering caused by these monetary policy failures. Consequently, I have been blogging away at these issues along with like-minded folks such as Scott Sumner, Nick Rowe, Bill Woolsey, Josh Hendrickson, Marcus Nunes, Nicklas Blanchard, Kantoos, and David Glasner. We all have been making the case that the prolonged economic slump has been mostly due to passively tightened monetary policy that could easily be loosened,

even at the interest rate zero bound.

Our collective efforts have been summarized in a recent

paper by Lars Christensen, who labels us as a group

Market Monetarists. He argues that we are a burgeoning economic school born out of the Great Recession experience whose views have largely taken shape in the blogosphere. What defines us, he says, is (1) our belief that this crisis has it origins in monetary policy failure rather than problems in the financial system, (2) our emphasis on using market signals to determine the stance of monetary policy, (3) our view that monetary policy's influence on nominal spending is not constrained by the interest rate zero bound, and (4) our push for nominal GDP level targeting as way to get monetary policy back on track.

While I largely agree with Christensen's assessment of our views, there are some additional points worth noting.

First, though Market Monetarism has been largely a blogging phenomenon it has had important voices in other mediums. Ramesh Ponnuru has been pushing the Market Monetarist view at the

National Review and at

Bloomberg while MKM Chief Economist Michael Darda has been promoting it in the MKM investment

newletter and on interviews on CNBC and Bloomberg Radio. And even within the blogging medium there are other prominent voices like that of

Matthew Yglesias,

Ryan Avent, and

Brad DeLong who often are sympathetic to Market Monetarists views.

Second, Market Monetarists prescriptions are not all that different than those of prominent New Keynesians like Michael Woodford and Paul Krugman. We all agree that when the zero bound is hit the monetary base and t-bills became perfect substitutes and so the Fed should buy longer-term treasuries or foreign exchange as part of a plan to hit some explicit nominal target. A big difference, though, between New Keynesians and Market Monetarists is that where the former sees the move from t-bills to other assets as a discrete jump from conventional to unconventional monetary policy, Market Monetarist see it as simply moving down the list of assets that can affect money demand. The zero bond for us really is not a big deal, but simply an artifact of monetary policy using a short-term interest rate as the targeted instrument. We approach monetary policy with much less angst than New Keynesians.

Third, Market Monetarist stress NGDP level targeting because doing so would forcefully shape expectations. Here is why. Under such a monetary policy regime, the Fed would announce (1) its targeted growth path for NGDP and (2) commit to buying up as many securities as needed to reach it. Knowing that the Fed would be willing to buy up trillion of dollars of assets if necessary to hit its target would cause the market itself to do much of the heavy lifting. That is, the public would adjust their portfolios in anticipation of the Fed buying up more assets and in the process cause nominal spending to adjust largely on its own. This would reduce the burden on the Fed and make it a less polarizing institution.

Finally, one critique of Market Monetarist is they lack an active research agenda and fail to take advantage of formal modeling methods like DSGE models. While I cannot speak for all Market Monetarists, I can say that Josh Hendrickson and I have several research projects that formally evaluate the Market Monetarist view. For example, we have one paper where we make use of the search models developed in the New Monetarist's literature to formally develop a monetary theory of nominal income determination. We also make use of structural VARs to examine the importance of nominal spending shocks in one paper and the portfolio channel of monetary policy in another paper.

With that said, Lars Christensen has done us a favor by documenting the rise of Market Monetarism. It will be interesting to see what will be the long-run impact of the Market Monetarist bloggers . I am glad to have been a part of the journey so far.

P.S. Lars Christensen is of the Market Monetarist persuasion too and now is

blogging.