A few weeks ago I attended a

conference on international monetary stability at Stanford's Hoover Institute. It was an interesting conference that John Taylor nicely summarizes

here. I was fortunate enough to

present one of the papers at the conference and got great feedback on it. The paper, coauthored with Chris Crowe, looks at two roles played by the United States in the international monetary system. First, the U.S. financial system effectively acts as a banker to world and second, the Fed has inordinate influence on global monetary conditions. We document these two roles and consider how they interact.

In this post I want to discuss the first role since it relates to an important ongoing problem previously covered here, the safe asset shortage. In my next post I will cover the second role and see how it interacts with the first role.

Safe Asset Shortage

As I have noted before, there is an ongoing

safe asset shortage problem. The U.S. financial system is an important part of this story since it is a key supplier of safe assets to world. Lately, however, it has not been supplying enough safe assets to satiate demand for them. In fact, just yesterday we

learned the following:

The US government paid off more debt than it issued last month in a stunning turn-around for America’s public finances, causing an acute shortage of bonds and a further downward slide in borrowing costs.

Net issuance of notes and bonds by the US Treasury plunged below zero in April as tax revenues surged, a feat last achieved for fleeting moments at the end of the global economic boom in 2008.

Normally, this would be a welcomed development but right now it may actually weaken the global economy. For since the crisis in 2008, there has been an increased demand for safe stores of value--especially U.S. treasuries--that has pushed short-term interest rates to the zero lower bound (ZLB) in many parts of the world. That development, in turn, has prevented markets from clearing. That is, the ZLB put a price floor under short-term interest rates or, alternatively, a price ceiling on the price of safe assets.

Cabellero, Fahri, and Gourinchas (2016) show that this constraint creates pressures that get cleared elsewhere, primarily in the output market. That is, real economic activity will be the adjustment mechanism once prices quit working at the ZLB. Moreover, the problem will bleed over into other countries that provide safe assets. And this is exactly what we see:

U.S. Financial System as Banker to the World

One solution to the safe asset problem is to increase the supply of safe assets. Enter the U.S. financial system. The United States, as a whole, tends to borrow short-term at low interest rates from the rest of the world while investing abroad in long term in riskier assets that earn a higher yield. By doing this, the U.S. financial system provides safe, liquid assets to the rest of the world while funding economic development abroad.

This tendency was first observed by Kindleberger (1965) and Despres et al. (1966) who saw these activities as nothing more than the maturity transformation service of a bank. They therefore called the United States the “banker to the world.

Gourinchas and Rey (2007) argue that not only is the United States financial system acting as banker to the world, it increasingly acting as a venture capitalist to the world. They note that over the past few decades an increasing share of U.S. foreign investments, funded by its short-term liabilities to foreigners, became directed toward riskier assets.

The banker to the world role can be seen in Figures 1-3 which show various parts of the external balance sheet of the United States. Figure 1 shows U.S. liabilities to the rest of the world. The assets under the blue area are the liquid assets, with the darker blue being the more liquid. The gray area covers derivatives, which we assume are consider liquid assets apriori (e.g. AAA-rated CDOs). The pink and red areas are FDI and corporate equity, the riskier assets. They make up a relatively small share of U.S. liabilities to the world. Liquid assets dominate U.S. liabilities to the world.

If we now look at the asset side of the U.S. external balance sheet we see the opposite story. Here FDI and corporate equity make up a larger share. We also believe the derivative portion on this side of the balance sheet is most likely geared toward riskier assets as well. Consequently, the asset side is weighted toward risky, higher yield assets.

Figures 1 and 2 look a lot like a bank's balance sheet. To see this more clearly, the next figure shows the share of liquid assets on the liability side and the share of risky assets on the asset side. As you can see, the riskier asset share has been growing and is now over 70% of U.S. claims on the world. Meanwhile. liquid U.S. liabilities to the rest of the world sits just above 60% of outstanding liabilities.

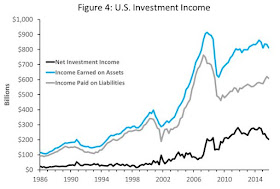

So like a bank, the U.S. tends to fund short-term and invest long-term with the rest of the world. And like a bank, it earns a positive spread between what gets on its investments and what it pays on its liabilities:

Implications of Banker to the World Role

That the U.S. financial system plays this role has several implications. First, the U.S. economy has a greater debt capacity than would otherwise be the case. Over the past few decades, the world has become more financially integrated. However, there has not be an commensurate increase in financial deepening across the globe. Consequently, foreigners have increasingly looked to the U.S. financial system as a key producer of safe assets given its deep markets and relatively good institutions. The U.S., in other words, has a comparative advantage in exporting debt! This used to be a joke, but time has shown there is truth to it.

Second, this role also implies the growth of U.S. debt is partly endogenous to global demand for safe assets. The growth of U.S. public debt, therefore, is not just a result of Congress and the President passing budgets. It is also the result of the strong foreign demand for our treasury securities putting downward pressure on yields and making it easier for our politicians to run budget deficits. The sustained decline in yields since 2008 suggests the world wants more treasury issuance. (This speaks to the Triffin dilemma for safe assets

covered here)

Third, given the absence of other reliable large-scale providers of safe assets, it is hard to see how there could be a 'run' on this banker to world in the decade ahead. To be clear, and as we show in the paper, there are other providers of safe safe assets like the United Kingdom and Germany. But they cannot produce the same scale of safe assets as the United States. This does not mean the U.S. government should become complacent in dealing with unfunded long-term liabilities, but it does mean fears of bond vigilantes are overblown. What other safe assets would investors run to in a 'bank run' on the U.S. financial system?

Recent Developments

It is useful to take a closer look at the recent trends in the U.S. supplied safe assets to world. The figures below takes the liquid assets categories from the first figure above and plots them individually in two separate figures.

The first figure below shows the publicly provided or backstopped (i.e. deposits) safe assets to the rest of the world. The key takeaway from this figure is that the demand for treasury securities, deposits, and cash grows the most. They, seemingly, are considered the safest of the safe assets.

The next figure shows the privately supply U.S. safe(ish) assets to the world. The path of short-term private safe assets like repos, commercial paper, money market mutual funds as well as longer-term private-label MBS follow an expected boom-bust path. Only the demand for corporate bonds seem to be relatively stable.

In the last figure below, we combine the above figures into one with two time series. The first series is the the safest of the safe assets: treasuries, deposits, and currency. The second series is all the other liquid assets above summed together. An interesting story emerges. During the housing boom period the demand for the super safe assets declines relative to trend while demand for the other (slightly less safe) liquid assets grows above trend. Since the crisis the opposite has happened: demand for the super safe assets has soared while the less safe liquid assets has declined. Risk aversion is high in the global economy.

Okay, so what does changing composition of global demand for U.S. safe assets mean? In my next post I will provide the answer my coauthor and I provide in our paper.