My latest Macro Musings podcast is a special holiday edition on the economics of Christmas.Two special guests joined me all the way from Germany to discuss this topic. My first guest was Anna Goeddeke, a professor of economics at ESB Business School in Reutlingen, Germany. My second guest was Laura Birg, a postdoctoral researcher at the Center for European, Governance, and Economic Development Research, University of Göttingen

Together they coauthored an article in Economic Inquiry titled “Christmas Economics—a Sleigh Ride” that surveys and summarizes the economics literature on Christmas. It is a great read for this time of the year and was the basis of our conversation. We touched on a number of interesting topics like the seasonal business cycle, the deadweight loss of Christmas, and charitable giving during the holidays.

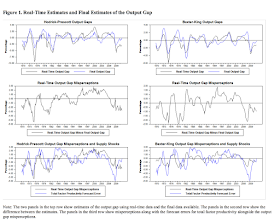

The seasonal business cycle discussion was particularly fascinating for me. There is a literature that starts with Barksy and Miron (1989) (ungated version) that shows most of the variation in aggregate economic measures like GDP comes from seasonal fluctuations. Yet most macroeconomists, myself included, typically start our analysis with seasonally-adjusted data. Here is a Barky and Miron summarizing their findings on GDP for 1948:Q2-1985:Q5:

The standard deviation of the deterministic seasonal component in the log growth rate of real GNP is estimated to he 5.06%, while that of the deviations from trend is estimated to be 2.87%. Deterministic seasonal fluctuations account for more than 85% of the fluctuations in the rate of growth of real output and more than 55% of the (percentage) deviations from trend. Business cycle fluctuations and/or stochastic seasonal fluctuations represent a relatively small percentage of the fluctuations in real output. Plots of the log level of real output (Figure 1) and the log growth rate of real output (Figure 2) make this point even more clearly. The seasonal fluctuations in output are so large and regular that the timing of the peak or trough quarter for any year is rarely affected by the phase of the business cycle in which that year happens to fall.

Unfortunately, the BEA no longer makes available non-seasonally adjusted GDP data. However, we can look at other times series to see how large seasonal swings can be relative to recessions. For example, below is retail sales:

What makes this really interesting is that these wide swings in economic activity are not matched by similarly-sized swings in the price level. Most of the seasonal boom is in real activity. Put differently, there is an exogenous demand shock every fourth quarter where prices remain relatively sticky so real activity surges. This is a microcosm of demand-side theories of the business cycle. It seems, then, that more could be learned about broader business cycle theory from studying GDP and other time series in their raw non-seasonally adjusted form. That will have to wait, however, until the BEA starts releasing the data.

This was a fascinating conversation throughout. You can listen to the podcast on Soundcloud, iTunes, or your favorite podcast app. You can also listen via the embedded player above. And remember to subscribe since more shows are coming.