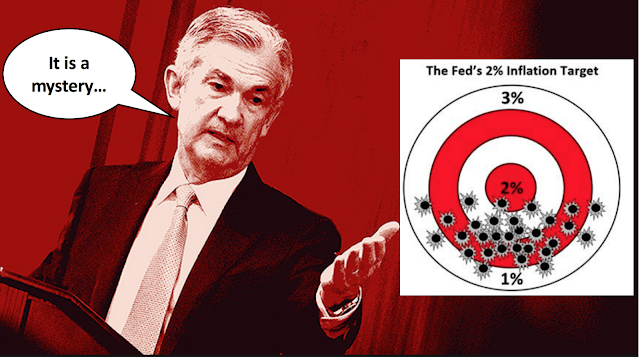

Over the past decade, inflation has persistently undershot the Fed's inflation target. The Fed's preferred measure of inflation, the core PCE deflator, has average 1.56 percent over this time compared to a target of 2 percent. The Fed officially begin inflation targeting in 2012, but was implicitly targeting 2 percent long before that time. So below-target inflation has been happening for close to a decade and for many observers it is a mystery.

There have been a spate of articles as to why the Fed has not been able to hit its inflation target. Some have wondered if the Fed really understands or even controls the inflation rate. Even Fed officials have been perplexed by the low inflation since it cannot be explained by their Phillips curve models. As a result, they sometimes attribute the persistently low inflation to developments such as falling oil prices, demographics, global competition, changes in labor’s share of income, safe asset shortage, and even the rise of Amazon.

These explanations, however, are not satisfactory since the Fed should be able to determine the inflation rate over the medium to long-run. That is, the Fed should be able to respond over time to developments that might cause inflation to drift off target. The Fed should be, in theory, the final arbiter of the trend inflation rate.

So why has inflation been so low? In my view, the answer is simple: the Fed is getting the inflation it wants. There is no mystery. One does not get a decade of trend inflation that is below target by accident. Instead, revealed preferences tell us inflation is where it is because the FOMC allowed it to be there. Put differently, the Fed has chosen not to fully offset the shocks and secular forces listed above that have pushed inflation down. This is a policy choice.

Fed officials and others may disagree, but the revealed preference argument is hard to ignore. Moreover, there are other reason to believe that the low inflation is, in fact, the desired outcome of the FOMC. They are presented below.

SEP Core Inflation Forecasts

The first reason to believe the low inflation is a desired outcome comes from the FOMC itself. The FOMC's Summary of Economic Projections (SEP) provides a central tendency forecasts for core PCE inflation. The FOMC's definition of the SEP is as follows (my emphasis):

Each participant’s projections are based on his or her assessment of appropriate monetary policy.

The SEP, in other words, reveals FOMC members forecasts of economic variables conditional on the Fed doing monetary policy right. And up until recently, doing monetary policy right was not overshooting 2 percent inflation in the following year, as seen in the figure below. Even now, 2 is still seen largely as a ceiling. There is nothing symmetric about 2 percent in these SEP forecasts.

Most FOMC members, therefore, have treated 2 percent as a ceiling over the past decade. This is "appropriate" monetary policy for them. Keep in mind, that at this forecast horizon most of them also believe they have meaningful influence on inflation. Both of these observations point to the low inflation as a choice.

Textual Analysis

The second reason to believe that low inflation is a desired outcome comes from a recent study by the San Francisco Fed. It is titled "Taking the Fed at its Word: Direct Estimation of Central Bank Objectives using Text Analytics" and the abstract reads (my emphasis):

We directly estimate the Federal Open Market Committee’s (FOMC) loss function, including the implicit inflation target, from the tone of the language used in FOMC transcripts, minutes, and members’ speeches. Direct estimation is advantageous because it requires no knowledge of the underlying macroeconomic structure nor observation of central bank actions. We find that the FOMC had an implicit inflation target of approximately 1.5 percent on average over our baseline 2000 - 2013 sample period.

Fed officials, via their words, actually want 1.5 inflation on average. And shocker of all shockers, they are very close to getting that just that rate of inflation since 2009.

The Neel Kashkari Counterfactual

The third reason to believe low inflation is a desired outcome comes from imagining a counterfactual FOMC. Imagine a FOMC that has twelve members that are all clones of Neel Kashkari, as seen below. In this FOMC, where interest rates were not raised over the past few years--and maybe even lowered--do we really think inflation would be the same? I find that hard to believe.

To be clear, I do think there are important secular forces pushing down trend inflation, like the demand for safe assets. But again, the Fed should be able to offset such pressures if it chose to do so. The real question, then, is why the Fed has settled for trend inflation near 1.5 percent. That is a question for a different post. This post is simply a retort to all those who think the low inflation is a mystery. Folks, it is not a mystery. It is a choice.

It is worth nothing that this choice is actually more than a choice for trend inflation. It is implicitly a choice for lower trend aggregate demand (AD) growth. As seen below, aggregate demand growth was averaging 5.6 percent in the decades before the crisis. Since the recovery started, it has averaged about 3.6 percent. That is a 2 percentage point decline in the trend. The red line in the figure shows what a naive autoregressive forecast would have predicted over the past decade conditional on past nominal expenditure history. There has been a sizable AD shortfall.

In my view, it is this dearth of aggregate demand growth rather than the low inflation that is a problem. The slowdown in AD growth has arguably contributed to problems like hysteresis and populism. If so, this policy choice has been costly.

P.S. Adam Ozimek gives us estimates of how costly this AD shortfall has been.

P.S. Adam Ozimek gives us estimates of how costly this AD shortfall has been.

I would expect the savings rate to be factor. There was an 10+% jump last year if I remember correctly. I believe your conclusion is correct. We are more conservative with our finances (especially with us baby boomers scrambling to provide for our retirement).

ReplyDeleteI estimate the output gap right now at about 1.5%. don't think it could be that high?

ReplyDeleteI enjoyed the Neel Kashkari photograph. That's my idea of a "Dream Team."

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteYour points are very well taken.

ReplyDeleteBut, with core PCE runing at below 2%, we had seen asset bubbles bursing in around 2001 as IT bubble, and in around 2008 as so called Leman shock.

Are you suggesting a bigger bubble bursting in 2019 or 2020?

I am not yet convinced your 5.6% trend nominal expenditure line should be a norm.

In 2018, US nomical gdp grew at around 5%, and is likely to dontinue to grow at around 4% or 5% in 2019.

With excessively pro-cyclical macro economic policies in both fiscal and monetary arena in the US, I wonder if the US not only could overshoot nominal gdp target path. but also could be easily trapped into twin fiscal and external deficits.

I am also a bit concerned if you may be focusing on a simple and closed macro economic model. Clearly, even US economy cannot be independen of externalities coming out of other economies.

For example, low inflation in the US may have just resulted from the dollar appriciation as a result of the Fed policy normalization.

More open economic approach and\or international policy cordination issue should be addressed to understand better where the US economy is and where it will go from here.

Best regards,

Former World Bank economist

It kind of makes sense if the Fed diagnosed the root cause of the housing "bubble" as excess credit fueled speculation and hasn't revised its opinion since. In their mind, they might think 1.5% inflation is an acceptable compromise between avoiding bubbles - particularily housing bubble - repeating and still have enough inflation to prevent stalling.

ReplyDeleteIF they misdiagnosed originally, and the root cause isn't excess credit, then they are still way too optimistic about the economy. They hiked 2% since -17 and the yield curve inverted. This isn't supposed to happen. It probably wouldn't if they hadn't strangled the supply of credit to the most aspirational part of the housing market. Before -08 atleast the wealth trickled lower down.

The lack of aggregate demand is a clear problem. We do have inflation, but it's all at the high end: luxury apartments, corporate ownership, pedigreed artwork. The demand for those things doesn't show up as aggregate demand, but it is only purchasers of that kind of thing who have money.

ReplyDeleteWell, it’s a clever approach, but, it assumes a total control from the Fed, they meet that they want!! Something doubtful in an uncertain world ... even for the Fed. Going trough the pieces of evidence, as regards expected core PCE, one year ahead seems to me incomplete, to say the least. And about text analytics, well, I have to go trough the paper, thanks for the reference

ReplyDeleteI am with you up until the last bit about lower aggregate demand growth. Not sure I believe low inflation "implies" or causes lower aggregate demand growth, at least in the sense you seem to mean. I would think that over the long run the Phillips curve is flat. Real growth should be independent of inflation.

ReplyDeleteHowever, I think that its more like this: The Fed is implicitly targeting nominal growth in order to ensure that inflation stays below 2%. Or if you prefer, they are using a taylor rule framework. If we print a good growth number or jobs number, probability of Fed raising rates goes up. The Phillips curve is baked into Fed policy even though empirically I think it is suspect.

So perhaps this is a bit nuanced, but I do not think that lower inflation "implies" lower aggregate demand, I think its more accurate to say Fed policy drives both, because of their deep seated belief in the natural rate of unemployment (which has proven to be wrong over the last 10 years).

dwb, two points. First, I did not mean to imply that low inflation causes low aggregate demand. Rather, the other way around. Second, I agree with you on long-run money neutrality in 'normal' non-ZLB environments. But coming out of the prolonged ZLB environment, I believe hysteresis effects were stronger and therefore required more robust aggregate demand growth even after December 2015 (when we left the ZLB). I plan to more formally work through this is a short paper soon.

DeleteLow inflation helps people who have loaned money at the expense of people who have debt. Since it tends to be the lower income people who owe and the higher income people who loan, this favors the higher income brackets. Because lower income people spend more of their income than higher income people, sending money to higher income brackets lowers demand. That's a fairly direct link from low inflation to reduced demand.

ReplyDeleteyes and no. You are correct that inflation is essentially a tax on savings ("people who have loaned money"...), so low inflation lowers the tax.

DeleteHowever it only affects people to the extent changes in inflation are *unexpected.* If I loan money at 4%, anticipating 2% inflation and a 2% real return, if actual inflation turns out to be 2% over the life of the loan I got exactly the return I expected. I am only better or worse off to the extent actual inflation deviates (on average) from what I expected when I loaned the money.