Christina Romer has an Op-Ed on U.S. monetary policy that raises several important points. First, she does a good job explaining that monetary policy can still pack a punch even when short-term interest rates are close to zero. She reminds us that unconventional monetary policy during the Great Depression--the original QE program--did wonders for the economy in a far worse economic environment than today. If it did such an incredible job back then, why couldn't it do the same today? This is a point I made late last year to Paul Krugman. It should encourage folks like him and Mark Thoma to be more optimistic about what monetary policy can do to shore up the recovery.

Second, Romer explains why U.S. monetary policy is not doing more given its untapped potential. She attributes this failure to to a polarizing division among two types of policymakers: empiricist and theorist. Here is how she describes them:

Empiricists, as the name suggests, put most weight on the evidence. Empirical analysis shows that the main determinants of inflation are past inflation and unemployment. Inflation rises when unemployment is below normal and falls when it is above normal.

Though there is much debate about what level of unemployment is now normal, virtually no one doubts that at 9 percent, unemployment is well above it. With core inflation running at less than 1 percent, empiricists are therefore relatively unconcerned about inflation in the current environment.

Theorists, on the other hand, emphasize economic models that assume people are highly rational in forming expectations of future inflation. In these models, Fed actions that call its commitment to low inflation into question can cause inflation expectations to spike, leading to actual increases in prices and wages.

For theorists, any rise in an indicator of expected or future inflation, like the recent boom in commodity prices, suggests that the Fed’s credibility is at risk. They fear that general inflation could re-emerge quickly, despite high unemployment

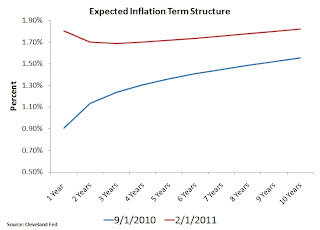

I don't like this division. It creates the impression that all empiricists don't use foward-looking theory to asses their reading of the data. Far from it. Take, for example, the core inflation measurement mentioned above. The only reason policymakers look to this is because it provides an indicator of where trend inflation is headed. Also, many empiricists look to explicit forward-looking market measures found in various assets prices. The most obvious one is the expected inflation series that comes from the spread between yields on nominal and real treasury securities. Empiricists are looking to these forward looking measures and see no runaway inflation on the horizon. For example, below is the expected inflation term structure--the expected inflation rate across various forecast horizons--from the Cleveland Fed. This data is a cleaned-up version of the expected inflation series implied by treasury securities.

This figure shows that since QE2 1-year inflation expectations have gone from 0.90% to 1.80% while 10-year inflation expectations have gone from 1.55% to 1.82%. These numbers are low relative to the implicit 2.00 to 2.50% inflation target of the Fed. Empiricists care about these indicators because they understand the importance of keeping them anchored. So far, though, there is no sign of them becoming unanchored. If any thing, the theoretically-driven empiricists see a reanchoring of inflation expectations that is pulling them down and preventing a more robust recovery.

So what is the solution? Christina Romer suggests a price level target. It would be a vast improvement over QE2 in terms of efficacy and it would add more long-run certainty. However, for the reasons outlined here, an even better alternative would be a nominal GDP level target.

Update: Marcus Nunes and Steven Williamson also respond to Christina Romer's piece.

Update: Marcus Nunes and Steven Williamson also respond to Christina Romer's piece.

I like the NGDP target, but wonder if the public will like it. The public hears the word "inflation" and goes bananas, as do certain economists.

ReplyDeleteMaybe NGDP targeting should be done, but sold as "setting an ceiling on inflation."

"I don't like this division. It creates the impression that all empiricists don't use foward-looking theory to asses their reading of the data. Far from it."

ReplyDeleteEconomists keep telling us Romer outshines so many of her peers as an economist -- and Romer keeps showing us all variety of incompetence.

She gets all wrong something fairly obvious here.

Are most macroeconomist so much worse?

Well feels like Groundhog day around here, but I think John Cochrane already effectively demolished this thesis. Its not about monetary policy. If you think deleveraging is the problem, then we should perhaps be looking to some kind of debt jubilee to relieve homeowners for example. But maybe Arnold Klingon has it right with his recalculation thesis. And again, monetary policy doesn't help that.

ReplyDeleteDavid

ReplyDeleteI this paper will prick your interest!

http://www.nber.org/papers/w16815