Rather, there is a 2% upper bound to the Fed's inflation target. This is an argument that Ryan Avent, Matt Yglesias, Paul Krugman, and others have been making for some time. I am sympathetic to this view and have made the case that the Fed has been effectively targeting a core PCE inflation corridor of 1% to 2% over the past five years. The evidence continues to mount in favor of this view.

First, consider the timing of the Fed's QE programs and changes in the core PCE inflation

rate as seen below. The figure suggests that the FOMC iniatiates

QE programs when core inflation is under 2% and has been falling for at least six months. It also indicates the FOMC tends to end QE programs when core inflation is above 1% and has been rising for at least six months. That ending of QE3 in October later this year follows this pattern.

Reinforcing this point, the Fed's purchases of treasuries since the crisis started is correlated with changes in core PCE inflation. Specifically, changes in the Fed's holdings of treasuries as percent of all treasuries can explain almost half of the variation in core PCE inflation since 2007 as seen below:

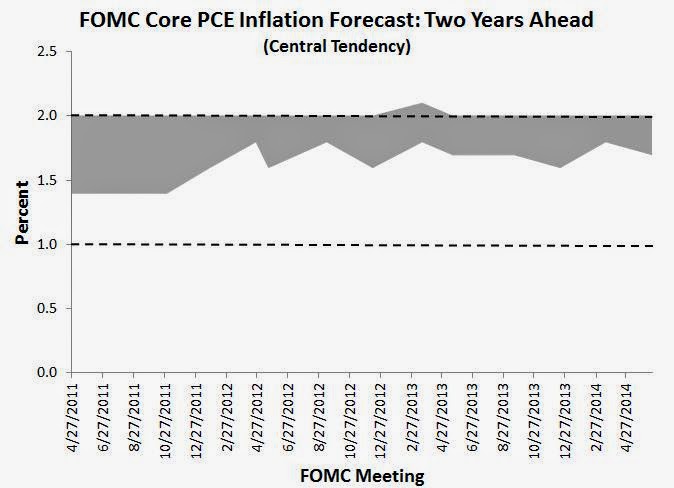

Second, consider the central tendency ranges of inflation forecasts

provided by members of the FOMC. This information can be found in the 'projection' material. These forecasts are consistent with the observed core PCE inflation data highlighted above. They consistently show 2% as an upper bound.

Though it gets clearer with longer forecast horizons, the 2% upper bound can be seen in the current, one-year, and two-year inflation FOMC forecasts shown in the figures blow. A 1% lower bound is most evident in the current year forecast, but slowly gets higher at longer forecast horizons. (Note: not every

FOMC meeting has projection materials, but for every meeting that does

provide them they are lined up chronologically in the figures.)

FOMC members are predicting inflation no higher than 2% even two years out.

Since the FOMC has meaningful influence on inflation this far out, this

forecast reflects FOMC members' beliefs about current and expected Fed policy. They see the Fed doing just enough to keep core PCE inflation under 2%. The actual core PCE inflation evidence provided above suggests the Fed is doing just that.

So it is all but official. There is no 2% inflation target.

Humorously, immediately after reading this I saw this new post by Ceccheti that argues "So, what might warrant such large stimulus? We can think of four possible reasons: (1) the Fed’s inflation objective isn’t really 2%, it’s higher;...we can explain the current level of the policy rate if we assume the Fed’s inflation objective is above 2%. Mechanically, using current data and the Taylor rule, the implied level of the inflation target is in the range of 6%."

ReplyDeletehttp://www.moneyandbanking.com/commentary/2014/7/10/is-the-fed-behind-the-curve

That is interesting. I tweeted them and hopefully they will reply.

DeleteI'm not so sure. Here is my alternative explanation. When it comes to inflation per se, the Fed really does symmetrically prefer 2%. However, FOMC members also prefer to avoid unconventional policy, and, when the expected inflation rate is below target and the federal funds rate is zero (or might be zero) there is a tradeoff between optimizing the inflation rate and minimizing unconventional policy. Looking forward, FOMC members see some probability that this situation will continue to be the case, in which case they will prefer a solution which involves below-target inflation. They also see some probability that they will be able to hit the inflation target without using (or risking the need to use) more unconventional policy. In that case, they will choose a course of action that results in an expected inflation rate of exactly 2%, because there is no tradeoff for inflation rates above 2% (since any excess inflation can be fought entirely with conventional policy).

ReplyDeleteIf you are correct and FOMC members are aiming for below-target inflation in this unconventional monetary policy environment they are prolonging the escape from the ZLB since they are preventing the take-off growth needed to return to normalcy. They are stuck in sub-optimal equilibrium.

DeleteDavid Beckworth

DeleteFrom FOMC statement:

"asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases."

Therefore aiming for below target inflation is prolonging escape but aiming for on target inflation may also prolong escape due to efficacy concerns. Maybe the fed isnt almighty operating under its current constraints.

One problem with my explanation is that it implies the Fed is not fully anticipating future uncertainty. If the Fed prefers exactly 2% but dislikes unconventional policy, it should be aiming for something higher than 2%, so as to reduce the risk of having to use unconventional policy in the future. I really do think that the Fed is being irrational here, though, rather than lying about the symmetry of its target.

ReplyDeleteThat would be a good point/question for a journalist, Congressperson or FOMC member to make to Yellen. They seemed to jump the gun in beginning to end QE. The market was surprised and rates went up. The Fed says they're still accelerating only more slowly by making fewer purchases each month. It's semantics. I see it as tightening in that their no longer accelerating as quickly as they once were. So they wanted to get out of QE as soon as safely possible. They did QE3 during the debt ceiling fiasco so maybe Bernanke made a deal with the hawks. If we get out of this, we'll tighten asap.

DeleteBut a journalistat a press conference (or Congressmen or FOMC member) should ask about the point your making: If the Fed would rather not do QE, why not give monetary policy some room so that they don't find themselves in that position again. Do they expect to use QE again in the future?

I am lucky to have stumbled across my old professor's blog again. Since we crossed paths, I've spent two years in the financial industry. Movements in the Fed seem to be a strong driver in investor sentiment these days, and I value your opinion on the matter. I'll make sure to follow up soon.

ReplyDeleteSincerely,

TSU alumnus who provided evidence of your citation in a book reporting the Argentine monetary crisis

Yeah, it's a ceiling 2 percent/PCE. Plosser can rhapsodize about deflation---3 percent below "target"---but what Fed member says 5 percent inflation (3 percent above target) is okay?

ReplyDelete