Former Fed chair Ben Bernanke blogged about secular stagnation today and he's not buying it:

Does the U.S. economy face secular stagnation? I am skeptical, and the sources of my skepticism go beyond the fact that the U.S. economy looks to be well on the way to full employment today. First... at real interest rates persistently as low as minus 2 percent it’s hard to imagine that there would be a permanent dearth of profitable investment projects. As Larry’s uncle Paul Samuelson taught me in graduate school at MIT, if the real interest rate were expected to be negative indefinitely, almost any investment is profitable. For example, at a negative (or even zero) interest rate, it would pay to level the Rocky Mountains to save even the small amount of fuel expended by trains and cars that currently must climb steep grades. It’s therefore questionable that the economy’s equilibrium real rate can really be negative for an extended period.

His successor, Janet Yellen, is also skeptical. She acknowledged in a speech the possibility of secular stagnation, but believes it is an unlikely outcome. Her baseline scenario is for the U.S. economy to continue to recover and, as a consequence, to continue to pull up the real equilibrium interest rate:

[T] economy's underlying strength has been gradually improving, and the equilibrium real federal funds rate has been gradually rising. Although the recent appreciation of the dollar is likely to weigh on U.S. exports over time, I nonetheless anticipate further diminution of the headwinds just noted over the next couple of years, and as the equilibrium real funds rate continues to rise, it will accordingly be appropriate to raise the actual level of the real federal funds rate in tandem, all else being equal.

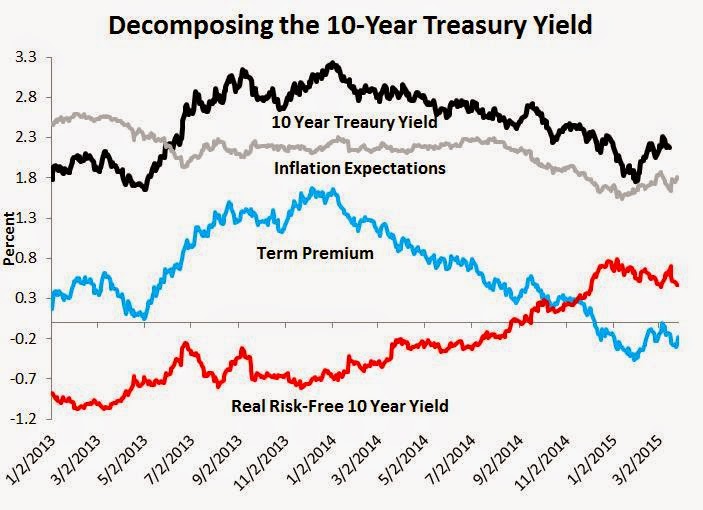

If we take the New York Fed's estimate of the 10-year treasury term premium and risk-neutral nominal rate as given, then the market is already pricing in a non-secular stagnation future as seen in the 10-year real risk-free treasury yield below:

The red line is a risk-adjusted measure of the expected average real short-term

interest rate over the next ten years. Put differently, this measure

reveals the expected path of real short-term interest rates and it is pointing up. Since it is risk free, it should only be reflecting the

expected fundamentals of the real economy over the next 10 years (see here for further explanation). It started rising in early 2014 and now has been positive for about five months. That bodes well for the economy.

But interest rates did stay low in Japan for 20 years while the economy was soggy...so low interest rates can persist, if not indefinitely, long enough...

ReplyDeleteMy guess is that "conventional" policy has lost its bite...lowering rates is not enough. Raising rates will change little.

It would not be surprising if the Fed follows in the footsteps of the Bank of Japan, and finds that it must return to QE...

After all, recoveries do not last forever...when this weakest of all recoveries sinks back to recession, then what?

Which raises a related question: must the Federal Reserve wait for a recession before initiating QE, or can it try to prevent a recession by going to QE first?

DeleteMy guess is the Fed will wait, although it should not.

Ben, you know my answer to all your questions is NGDPLT!

DeleteRe David’s NGDLP point, that’s about the thousandth time I’ve seen a market monetarist claim that setting a target automatically means you’ll reach the target. It doesn’t.

DeleteI can make it my “target” to spend my next holiday on the Moon, but unless I work out exactly how I’ll get there and come up with the 100 million or so that it costs, then I won’t get there.

Benjamin Cole is concerned about TRANSMISSION MECHANISMS and whether they’ll work. Quite right. I.e. he’s concerned about exactly how to get to the Moon. Quite right.

David, question about your chart. The red line is labelled real risk-free 10 year yield. Should we think of that series as representing one fixed real investment for a term of 10 years or a series of short term investments that are rolled over the course of 10 years?

ReplyDeleteHere's the original equation from a previous post with my edits:

long-term interest rate [black line] = (average expected real short-term interest rate [red line] + average expected inflation [grey line]) + term premium [blue line]

JP, since we have accounted for the term premium--the compensating differential between holding short-term and long-term securities--the red line represents both the fixed real investment for a term of 10 years and the series of short term investments that are rolled over the course of 10 years. They should be equivalent because of arbitrage.

DeleteNo one can argue the term premium measure of ACM doesn't capture all the compensating differentials between short-term and long-term securities but that is a measurement question.

David-

ReplyDeleteYes, but you do not answer the question: Would you go to QE before an actual recession? If interest rates stay dead for reasons we do not understand fully (and they are getting deader right now), does QE then become conventional policy, as it has in Japan?

Also, look for a pending post on Marcus Nunes. I commit heresy, and I will ponder if the Reserve Bank of Australia might be doing the smart thing by an IT band. I would prefer a slightly higher IT band, as in 2.5% to 3.5%.

Why? The growing underground or grey markets make measuring GDP iffy. I mean, you have $4,200 in cash circulating in the US, and no, it is not all offshore doing drug deals.

Also, there are some aspects of GDP that are not measured, such as cleaner air, urban amenities (including crime rates) or leisure time.

But the price signal is probably pretty well captured by survey, and reflects slack or tightness in the economy, with the usual caveats.

According to estimates, the FED will not increase interest rates before the end of the summer. Or perhaps we'll see a gradual rise ? Anyway, the process will be very slow...

ReplyDeleteWhat was really daft about Summers’s original secular stagnation speech to the IMF audience in 2013 was that his claim that interest rate cuts were the only way of implementing stimulus, thus when interest hits the ZLB, we’re allegedly stymied.

ReplyDeleteRobert Mugabe is clearly a lot smarter than Summers in that Mugabe realised (unlike many “sophisticated” Western economists) that governments can ignore interest rates and provide stimulus by simply printing money and spending it (and/or cutting taxes). MMTers tend to advocate the same method of stimulus.

Of course Mugabe took that process much too far. But he’s learned his lesson now. So if I was going to produce a list of economists with the smartest at the top, I’d place Mugabe above Summers and numerous professional economists.