Here is a quiz for all the hard-money advocates of the world: what common message do the following three figures tell us?

The first figure shows for the combined balance sheets of households, non-profits, corporations, and non-corporate businesses the percent of total asset that are liquid ones. The traditional money assets include cash, checking accounts, saving and time deposits, and money market funds. The figure is created using the flow of funds data. Note the sudden and sustained spike in the liquid share over the past few years: (Click on figure to enlarge.)

The second figure shows the velocity of various money measures. Note that all velocity measures have fallen and remain well below pre-crisis levels: (Click on figure to enlarge.)

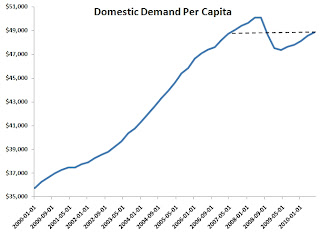

The third and final figure shows the level of total current dollar spending per capita. Note here that nominal spending per person as of the 2010:Q3 is where it was in 2007:Q2: (Click on figure to enlarge.)

So what is the common message coming from these three figures? The answer is below the fold.

The answer is that all these figures indicate there was a pronounced spike in money demand during this crisis and it is still lingering. The first figure shows this spike in money demand since the collective balance sheet shows an unusually large share of money assets. The second figure also indicates a money demand surge since the drop in velocity means there is less spending of outstanding money balances. The third figure shows domestic spending per capita has yet to return to its pre-crisis spending peak. Because domestic spending is equal to the money supply times velocity and given that the money supply has not collapsed, this figure similarly suggests a spike in money demand.

I bring this up because hard money advocates on the right like John Tamny seem to ignore this important point. If money demand has spiked, as these figures indicate, to an all time high then inflation fears are seriously misguided. In fact, it doesn't matter how much the monetary base or money supply increases if money demand increases more. There simply will not be inflation. Rather, nominal spending will falter as seen in the third graph and that, in turn, will weaken the economy. If anything, then, the collapse of total current dollar spending coming from the spike in money demand means monetary policy has effectively been too tight. QE2 is one attempt, though a sloppy one, to fix this problem as I explain here. For some reason, hard money advocates seem to turn a blind eye to money demand.

Scott Sumner likes to say the Achilles' heel of the conservative economics is monetary policy. Lately, I am becoming more convinced that an inattention to money demand is the Achilles' heel of the conservative economics.

Update: In an earlier version of this post I misrepresented Kevin Williamson by calling him a hard money advocate. His is not calling for a return to a metal standard so I changed the post to reflect this fact. My apologies to Kevin.

This is an excellent post. Well done, and readable.

ReplyDeleteAdd to that, unit labor costs are falling at 2 percent annual rate, and commercial rents of all kinds are flatter than a dead cobra.

I hope we can have some inflation, but I am not sure.

This comment has been removed by the author.

ReplyDeleteInteresting charts. I think it is normal for the private sector to go liquid in a recession or credit crunch. From a cursory look the first chart, the smaller spikes in the 1950s-90s coincided with recessions, but it would be nice to see those earlier recessions superimposed on the above chart.

ReplyDeletePresumably the big recent spike was caused by the fact that liquid assets had been reduced to record low levels, plus many of these liquid assets turned out to be phony.

There is something wrong in an analysis that concludes that lack of money is our problem. Companies have bundles of cash they will not spend. Banks have massive reserves they cannot or will not lend. There is significant commodity price inflation, and yet U6 remains around 19%.

ReplyDeleteLack of money is not causing a credit crunch for McDonalds or Microsoft. These companies are issuing bonds while having no need for the cash simply because rates are maintained so low by burdening future generations of Americans.

We are eating our young to provide loose money such that none of the asset price crashes that have occurred need be recognized. We are sacrificing people on fixed-incomes to bank balance sheets. I don't know how that fits into the "money demand" model, but that is what's happening.

Conservatives seem not to think about money in terms of supply and demand; they often have difficulty with the concept and are hostile with anyone who brings it up. Ironically, conservative economists often commit the same errors as vulgar Keynesians, e.g. confusing the demand for money with the demand for credit.

ReplyDeleteThe anonymous commenter above is a wonderful example of this kind of ignorance (and I do not mean that disrespectfully). The claim that we have enough money because "Companies have bundles of cash they will not spend" utterly misconceives the issue.

David,

ReplyDeleteCheck out Thomas Sowell's recent interview on Uncommon Knowledge over at nationalreview.com: he slams QEII and opposes further expansionary monetary policy. His explanation of why is all about the money supply; he assumes that banks have to start lending for monetary stimulus to work; and he appears to not comprehend any conservative case for quantitative easing.

This is disconcerting to me. I like Thomas Sowell. His book Basic Economics was what got me interested in economics a few years back. He is the kind of conservative economist that I usually have no trouble deferring to on a wide range of issues. But here he, like many others, probably would respond the views of you or me with some combination of bewilderment and scorn.

Anonymous:

ReplyDeleteLack of money is not the fundamental problem. Rather, it is the spike in money demand shown in this post. Yes, more monetary stimulus is the solution to this problem only to the extent it changes expectations and causes firms and households with excess money balances to spend them. See my National Review article for more on how monetary policy can address this money demand problem:

http://www.nationalreview.com/articles/253936/conservative-case-qe2-david-beckworth

Lee,

ReplyDeleteWe need a Basic Economics-type book that, among other things, explains monetary economics from a monetary disequilibria approach to a broad audience. If done right it could provide a way to reach conservatives. Maybe after I get tenure I should try to get some grant money for such a project.

David,

ReplyDeleteThat would be awesome. You are a good writer, and I am confident you would do a good job.

This and your Dec 30 post still do not convince me.

ReplyDeleteYes, there has been a tremendous increase in the demand for safe and liquid assets.

But I can say just as easily that this has been met by 1. the Federal Reserve providing reserves and cash, 2. Commercial banks and thrifts dramatically expanding demand and savings deposits, and 3. Federal, municipal governments issuing record amounts of debt, and large corporations issuing large quantities of bonds.

Even if the excess demand for the safety of bonds has not been entirely met by new issues, the upward pressure this puts on existing bond prices ensures that the market clears and the demand for liquidity/safety met. (This demand has created the bond bull market of the last 2 years.)

People continue to want a larger proportion of their portfolio in liquid assets than in times past. This demand has been met and/or prices have shifted to accommodate demand. There is no excess demand for money.

QE2 (and the like) does not meet some mythical excess demand for liquidity/safety. It creates an artificial excess supply of liquidity/safety (or an insufficiency of demand for liquidity/safety and an excess demand for illiquidity/risk).

JP Koning:

ReplyDeleteThe last figure in the post shows why I believe prices have not fully adjusted to jump in money demand: nominal spending has not fully recovered. If price adjustments had been sufficient this wouldn't be the case.

QE2 is about more than just satiating the rise in money demand. It is about changing expectations such that households and firms will not want to hold as many liquid assets and thus rebalance their portfolios accordingly. Ideally, QE2 would raise both nominal and real economic expectations and cause this reallocation to take place.

David, thanks for your response. Will mull it over. Look forward to future posts on this issue.

ReplyDelete